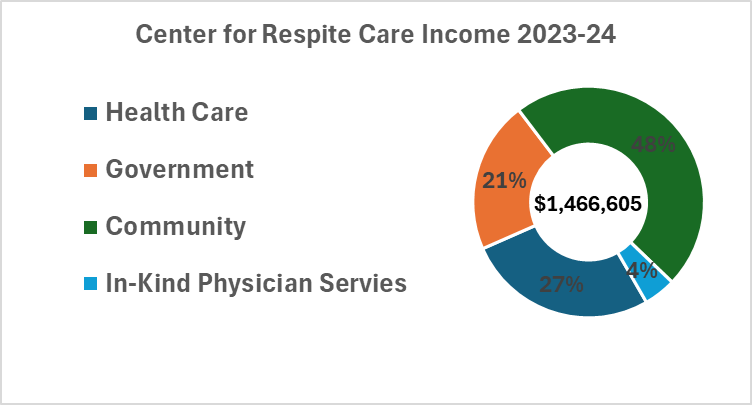

How the Center is funded – Thank you for your support!

Here is the income breakdown for the last fiscal year.

Hamilton County Tax Levy: We are the recipient of some levy funds and currently are preparing a submission for renewal.

Funding from the community comes in various forms, grants from foundations, donations throughout the year from individuals and local organizations – faith based and civic.

The Center turns to the community for two major fundraising drives. Our annual event, the Transformation Awards, has been presented since 2011. The past five years have been virtual, corporate and individual sponsorships and personal donations have secured its ongoing success. The 2024-25 Annual Appeal will close at the end of March. Here is a link to the public service announcement being run by our media partner Local 12. https://www.youtube.com/watch?v=ULTnNUQsUJM

We must express our gratitude to Michael Chertock and Friends whose annual holiday concert hosted by Sycamore Presbyterian Church is an awesome example of Third-Party fundraising in support of our clients.

The Center for Respite Care is thankful for all who support us. We must spend wisely caring for our clients and be good stewards of those who entrust us with their investment in the mission. Thanks to all who make this possible.

We have compiled a quick review from a recent webinar offered by the Council for Non-Profits that might help others to further navigate these times.

Navigating Through Times of Financial Crisis: A Guide for Nonprofits

A broad economic crisis can magnify a nonprofit’s pre-existing financial difficulties. While sound financial planning is essential in all economic situations, it becomes especially critical during unstable times. Successfully navigating financial crises requires communication, transparency, and proactive planning. The Nonprofit Finance Fund (NFF) recommends assessing financial risks and developing a response strategy to mitigate the impact of a recession. Below are key steps for nonprofits to prepare for and respond to economic challenges effectively.

Assessing Risk: Understanding the Financial Impact of a Recession

A recession can significantly impact a nonprofit’s revenue streams. To prepare for potential financial difficulties, organizations should evaluate the following risks:

- Possible Reductions, Delays, or Losses in Revenue Streams:

- Government contracts or grants may be reduced or delayed.

- Foundation and corporate giving may decrease due to budget constraints.

- Individual donations and revenue from special events may decline as donors experience financial hardship.

- Conducting a Program Economics Analysis:

- Determine if surpluses in some programs are subsidizing deficits in others.

- Identify which programs have the greatest impact on the organization’s financial health and mission fulfillment.

- Anticipate changes in demand for specific programs during an economic downturn.

- Assessing Liquidity and Financial Resilience:

- Calculate the number of months of expenses covered by available cash reserves.

- Determine working capital by evaluating current assets against liabilities.

- Review unrestricted net assets and ensure that reserve funds are available for emergencies.

- Verify that cash deposits are insured and investments are diversified to minimize risk.

Addressing Risk: Developing a Response Strategy

Once potential risks are identified, nonprofits should take proactive steps to address financial challenges. Below are key strategies for maintaining financial stability during uncertain times:

- Strengthening Internal Communication and Decision-Making:

- Ensure that decision-making processes are agile enough to respond to sudden financial changes.

- Clarify the financial responsibilities of both management and the board.

- Assess the board’s willingness and capacity to cover revenue shortfalls or tap into existing reserves.

- Budgeting Conservatively with Contingency Planning:

- Develop best- and worst-case budget scenarios.

- Assume that incoming cash will be delayed while expenses must be met promptly.

- Create a plan for addressing unexpected revenue shortfalls.

- Perform regular cash flow projections to anticipate financial needs.

- Maintaining Strong Relationships with Funders:

- Keep funders informed about the impact of the economic downturn and your strategy to adjust.

- Emphasize the importance of your mission and the urgent needs your programs address.

- Show appreciation to donors through frequent and personalized outreach.

- If your services help mitigate the effects of the recession, actively seek additional government funding.

- Exploring Revenue Diversification Cautiously:

- Consider new revenue streams but carefully assess the risks involved.

- Avoid hasty expansion into unfamiliar funding sources without thorough evaluation.

- Reevaluating Growth and Investment Plans:

- Reconsider any planned program expansions or the launch of new initiatives.

- Align programmatic priorities with the financial analysis of program viability.

- Communicate transparently with board members and staff about potential budget cuts or staffing reductions.

- Delay large infrastructure investments, including facility projects, unless necessary.

- Explore opportunities to renegotiate payables, debt obligations, or lease agreements to alleviate financial strain.

Conclusion

Economic downturns present significant challenges for nonprofits, but strategic planning and proactive financial management can help organizations navigate these crises successfully. By assessing risks, maintaining open communication, budgeting conservatively, strengthening relationships with funders, and making careful financial decisions, nonprofits can not only survive but emerge stronger. Preparation and adaptability are key to sustaining an organization’s mission and long-term viability during uncertain economic times.